What is Quality cost?

Quality cost is costs that caused through raised producing efforts and coming defect in processes to maintain standard product quality.

What is quality costs? Or Total quality costs?

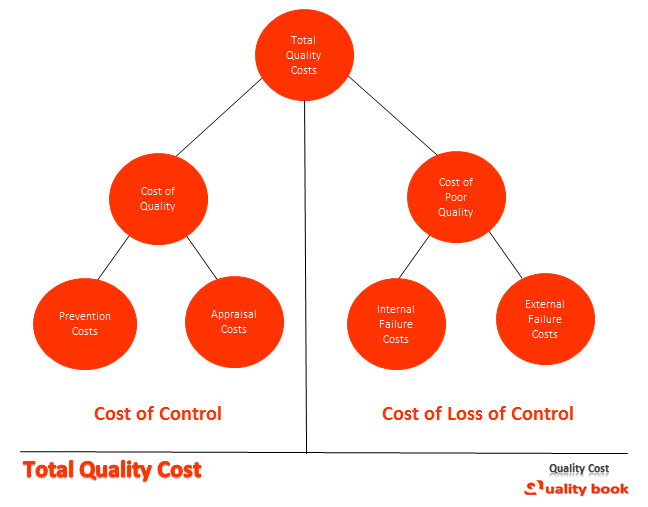

Quality costs / Total quality costs are the sum of: (1) Prevention costs (2) Appraisal costs (3) Internal failure and, (4) external failure costs.

Formula:

Total Quality Cost=

Cost of Poor quality (COPQ) + Cost of Quality (COQ)

or

Cost of Loss of Control + Cost of control

What is cost of poor quality (COPQ) or Poor Quality Costs (PQC)?

Cost of Poor quality (COPQ) is results of insufficient internal system, inefficient manufacturing processes and identified defective product produced.

Formula:

Cost of Poor Quality = internal Failure Costs (IFC) + External Failure Costs(EFC)

What is Cost of Quality?

Cost of quality is method or procedure that assistance to identify which manufacturing process, resources or activity cause poor quality of product that help to prevent it.

Formula:

Cost of Quality = Appraisal Costs(AC) + Preventive Costs (PC)

Quality Costs

(A) Total Quality Cost = Cost of Poor Quality + Cost of Quality

Or

Cost of Loss of Control + Cost of Control

(B) Cost of Poor Quality = Internal Failure Costs (IFC) + External Failure Costs (EFC)

(C) Cost of Quality = Appraisal Costs (AC) + Prevention Costs (PC)

Generally, peoples are misunderstood to define definition of quality costs. This is not costs of producing product or services even first time. It is simply we can define as costs, which associated with product quality.

Mostly in manufacturing units some general reasons that cause failures likes reworking of manufactured products. Re-inspection / testing of a production lines, re-construct or build of tools etc. In short, any cost that bear by organization as costs could be eliminating, if quality of product maintain perfect during various processes.

Data Collection

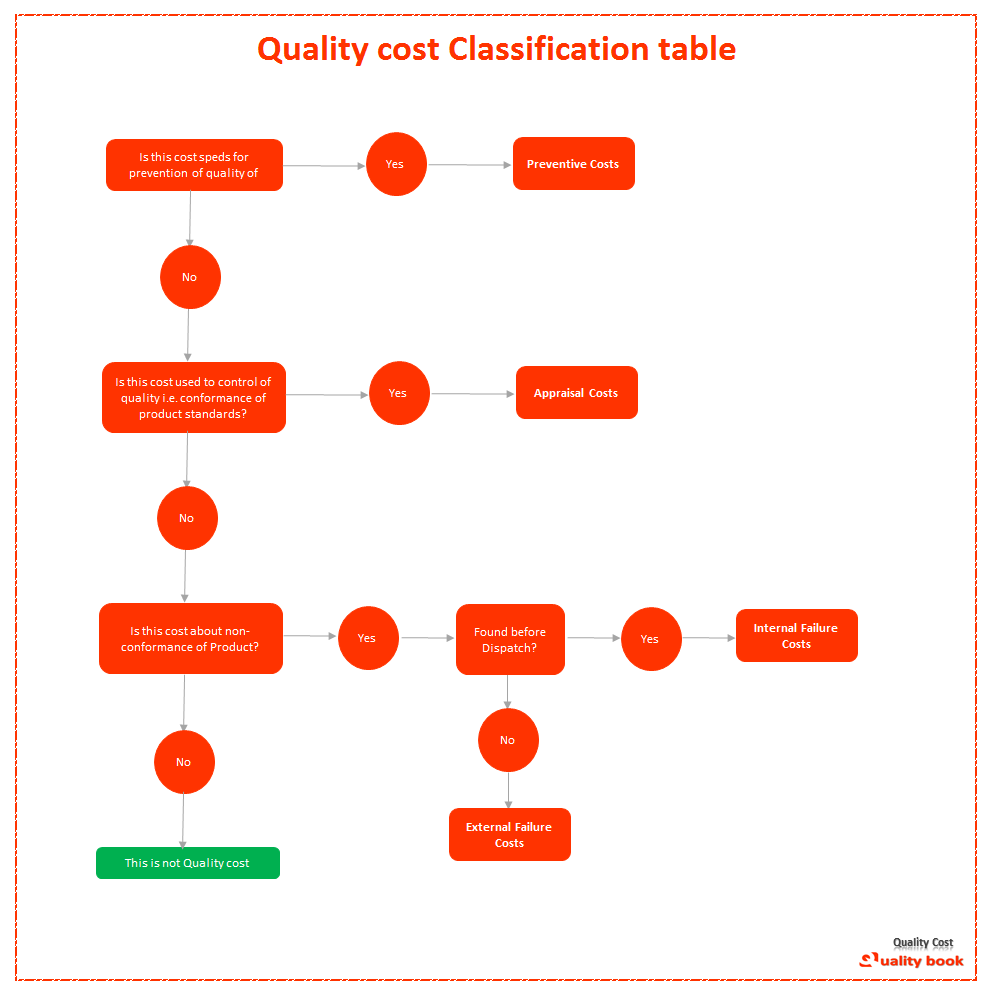

Management representative / Quality assurance manager will be complied, analysis on a monthly or standard frequency define by management on basis after obtaining data from various departments to comply all four elements of Costs. And all the collected information is managing for Costs analysis. All the collected information is managing by quality assurance / quality control manager to identify separate costs of each element of improvement quality to identify and control over there. But remember that:

“Cost Information does not solve any quality problems, nor it suggest specific solutions”

“problems are solved by tracking the cause of quality deficiency.”

So, management should track each cost information collected and analyzed. But how to analyze and track each cost information? OK, it’s possible through quality cost analysis as below.

Quality cost Analysis

Just collecting information of quality cost is not enough or does not solve any issues, its need to proper analysis and control on after to achieve following objectives:

- – Identify costs in a manufacturing processes / activities

- – Define measurements to be a easier to identify the costs that impact the overall costs.

- – Identify impact of measuring the cost of quality.

- – Setup priority for reduction / elimination of failures i.e. costs of loss of controls.

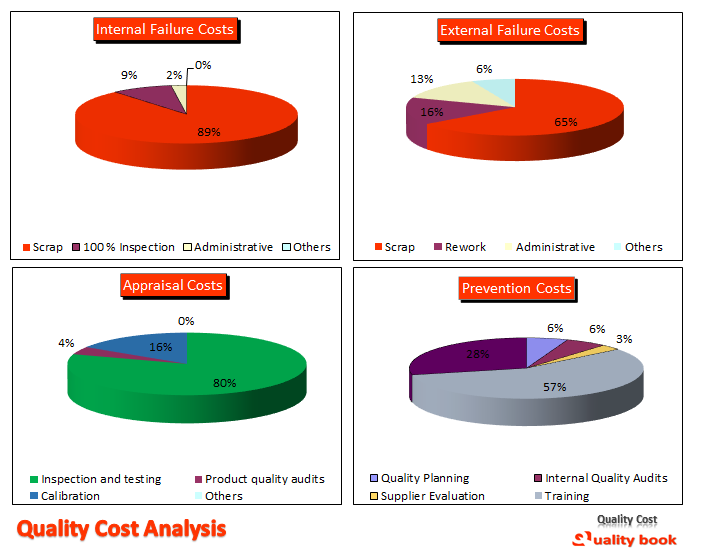

As you can see above picture describe all four elements of quality costs are analyzed separate contribution or costs particular in manufacturing processes, now the management can determine which cost is maximum or needs to setup on priority to minimize it or reduce overall costs. Here below given all costs wise describe to understand it, where and how it raises in manufacturing processes:

Cost of poor quality | Cost of Loss of Control

Cost of poor quality or cost of loss of control having a two major elements:

Internal Failure costs

An Internal failure costs are for the efforts devoted to products / services that do not meet standards / specifications with in manufacturing processes / workplaces activates, which shall comprise of one or more of the following:

- Scrap costs

- Rework / re-inspection / re-test costs

- Process Failures costs

- Administrative expenses costs

Internal failure costs are incurred when non-conformance identify before the product shipping, its concern to manufacturing and internal processes failure costs includes scrap and waste generating from various processes, reworks and re-inspection conducted due to product failure or needs to performing due to some failures. In short, this costs can disappear if production processes, internal system and resources perform perfectly.

External failure costs

External failure costs are for those efforts devoted to products / services that do not meet specifications / standards with external activities, which shall be comprise of one or more of the following:

- Customer returns / Customer complaints costs

- Warranty claims / Complaint adjustment costs

- Administrative expenses / costs

- Liability costs

When any defective products are supplied to customers cause external failure costs, which includes the customer returns and complains costs, warranty, materials adjustment costs and other liability costs raises due to any legal actions against organization as results loss of sales, reputation and profit.

Cost of quality | Cost of Control

Appraisal costs

Appraisal costs are for those efforts devoting to maintain quality levels by means of formal evaluations, which shall comprise of one or more of the following:

- Inspection and testing costs

- Product quality audits costs

- Calibration costs

- Inspection services costs

These costs are usually associate with evaluating, measurements and auditing products to assure product conformance to specifications and standard or as requirement of performance. Appraisal costs calculates to manage standard product requirements and those requirements are fulfilled by internal audits, incoming raw materials and in-process inspection, equipment and devices calibrations, internal laboratory testing, procedures evaluation and final product quality control activities.

Preventive costs

Prevention costs are for those efforts devoted to prevent defects from occurring, which shall comprise of one or more of the following:

- Quality Planning costs

- Internal Quality Audits costs

- Supplier Evaluation costs

- Training costs

- Maintaining quality management system costs

Preventive cost is the costs of manufacturing, all activities and process specifically design to prevent poor quality in products, and use resources in design to prevent loss of quality during manufacturing processes. In short to avoid quality problems of product preventive costs are incuring.

Generally, focus on preventive costs is recommends by all the expert, because of this cost can reduce and manage by effective way is having eliminate defects on preventive, its less costly than other costly if the problem occurred on after some stages of production lines.

Conclusion:

The quality team shall be calculating the TQC due to the costs of control and loss of control which shall principally consists of:

A. Appraisal Costs (AC) – Costs of control

B. Preventive Costs (PC)- Costs of control

C. Internal Failure Costs (IFC) – Costs of Loss of control / Cost of poor quality

D. External Failure costs (EFC) – Costs of Loss of control / Cost of poor quality

The Total quality cost the percentage of each cost factors should be properly calculate, and its should be evaluate monthly / periodically.

Some example / Table for reference:

| CONDITION / STATUS (AS PER TQC= 100%) | MONITORING |

|---|---|

| Internal Failure Costs + External Failure Costs > 70% & Appraisal Costs + Preventive Costs > 30% | Identify and analysis, Improvement in manufacturing processes |

| Internal Failure Costs + External Failure Costs < 40% & Appraisal Costs + Preventive Costs > 60% | Audit controls shall be tried |

Commonly, This should be require to compare the one of the measures. Such as total profits or total sales values as standards or sufficient time scale. The history shall be maintain to know the actual improvement.

Further management should actively have participating to setup Annual targets and should be monitor on standards. Which may helps to define the frequencies, to verify the effectiveness and to maintain the effective factors at the performance levels. After all Quality perception is raising by reputation and trust building.