An Activity-based costing (ABC) is a costing method that identifies overhead activities in an organization and assigns each product’s cost to each activity’s actual consumption of each.

This, in the process, builds up overhead costs for products in a more logical manner than the traditional approach of allocating costs based on equipment hours.

The Activity based costing first assigns expenses to the activities that are the actual cause of the overhead.

It then assigns the cost of those activities to only those products that are actually demanding activities.

This method provides accurate and detailed information and excellent understanding of the various processes of the products and the costs associated with them. This method is especially used in industries to improve cost management and decision making.

Activity-Based Costing (ABC)

- Provides more indirect costs in direct costs as compared to traditional costing.

- It identifies and calculates the cost of indirect cost (overhead) activities in the process.

- Determines the cost of each activity of products and services according to the actual consumption of each.

- Builds overhead costs for products in a more logical manner.

A business should include the creation of an ideal structure of actual costs at each stage of its core processes. Obviously, there is a cost associated with each activity, such that the cost of performing each activity may be built into the cost of producing the products or services offered by the organization. It is clear that, the cost contribution of each activity to the total cost for the business to manufacture its product must be determined.

The Concept of Activity-Based Costing (ABC)

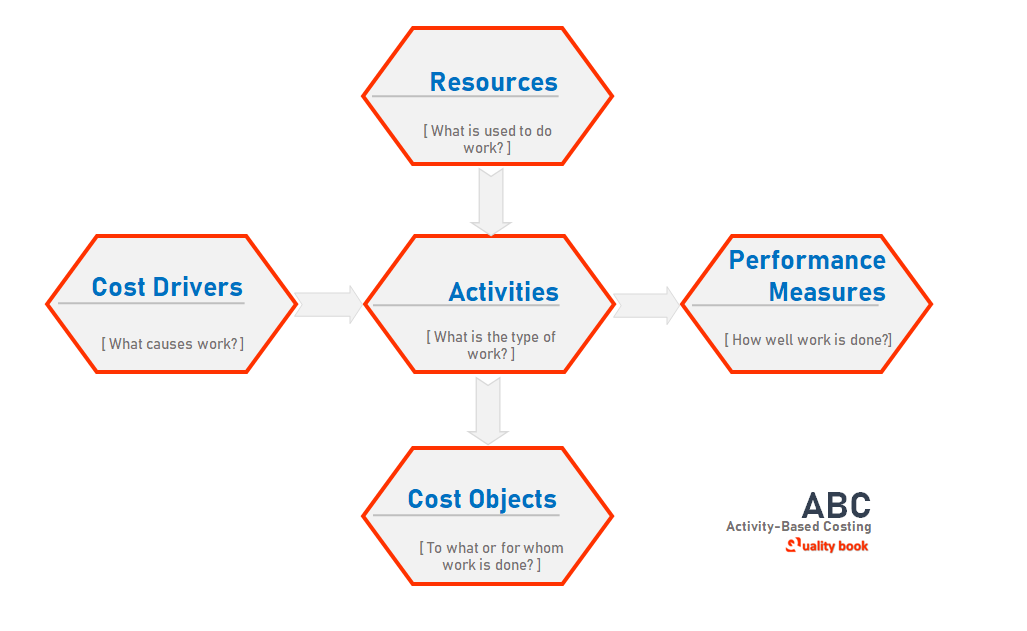

As you can see in the picture above, Activity-Based Costing (ABC) has several key concepts that are interconnected. Which are as follows:

Cost drivers

As you can see in the figure above, a cost driver is a factor arising from resource utilization.

For example, if a company produces a variety of products, the number of units produced can be used as a cost driver to determine the costs associated with producing each product.

By identifying the cost drivers for each activity, managers can understand which activities are consuming the most resources and target those activities for cost-saving efforts.

Resources

All the resources required for production in any production sector are used as inputs for production. These types of resources include – direct labour, materials and overheads etc.

Where the cost of all such types of resources are summed up in the calculation by ABC. It is assigned to the products or services that use it.

For example, a manufacturing business may have different types of resources such as direct labor, machines, materials, and utilities.

The cost of these resources is accumulated and assigned to products based on the use of these resources.

Performance Criteria

The Performance measures are metrics used to evaluate the efficiency and effectiveness of an activity. Examples of performance measures include the number of units produced per direct labor hour or the number of customer orders per day.

For example, a service company may use performance measures such as the number of customer complaints per month to evaluate the efficiency and effectiveness of their customer service department.

By using performance measures, managers can identify which activities are performing well and which are not, and target those activities for improvement efforts.

Cost Objects

A cost object is any item or activity to which costs are accumulated and assigned. Examples of valuable items include products, services, customers, or projects.

In ABC, the costs of resources are assigned to cost items based on their use of those resources. For example, a company that produces different types of products may use different cost objects, such as different products, to assign the costs of resources.

Activities

The Activities are specific tasks that are required to produce a product or service. Examples of activities include design, production, distribution, and customer service. In ABC, the costs of resources are accumulated and assigned to the activities that consume them. For example, a manufacturing company may have different activities such as design, production and distribution. The cost of resources is accumulated and assigned to these activities based on their use.

All these concepts are interconnect in ABC. Because the costs of resources are accumulate and assigns to activities that consume them. Which are then assign to the cost objects. That use those resources, base on their use.

The Performance measures are use to evaluate the efficiency and effectiveness of activities. And cost drivers are use to identify which activities consume the most resources and target those activities for cost-saving efforts.

What are the benefits of ABC costing?

Naturally, the question arises as to what the difference between traditional cost accounting methods and activity-based costing (ABC) methods is. Why activity-based costing (ABC) should be adopted. So the advantages of this detailed and accurate method of determining. The costs involved in the production of various products or services are as follows:

Improved costing accuracy

In contrast to traditional methods. The ABC method provides a more accurate picture of the costs associated with production. Thereby helping to focus on specific activities rather than using general cost allocation methods.

As we can see in traditional accounting where costs are allocated to a product based on direct labor hours or machine hours. But it does not take into account the various costs associated with the products. But where ABC shows costs based on the specific activities required for each product. It gives a more accurate understanding of the costs associated with each product.

Better Decision Making

By using this, managers of production areas can get detailed cost information. Based on such prices, managers can take accurate decisions about the allocation of resources for production. Such as using ABC to determine the true cost of production, setting prices in line with the cost of production, knowing which resource consuming activities are involved. So that managers can take accurate and more effective measures to save costs.

Enhanced Cost Control

As we saw in the step above, it shows that by identifying the activities that consume the most resources, managers can make cost-saving efforts more effective. Such as using an outsourcer for an identified activity or reducing costs by making that activity more efficient. Additionally, by gaining a better understanding of the costs associated with different products or services, managers can make better decisions about which products or services to produce and which to discontinue.

Increase understanding of customer profitability

By using ABC, a business can understand which customers are most profitable for the business and which are the least profitable. So, businesses can easily decide which customers to prioritize.

Better Product Profitability Analysis

Product profitability is analyzed in detail by ABC, which can help managers take decisions to improve profitability by identifying and discontinuing unprofitable products. Furthermore, by understanding the costs associated with different products, managers can make decisions about which products to produce and which to discontinue.

Steps of activity-based costing.

Activity-based costing (ABC) should include the following steps.

Analysis of activities

The purpose of this phase is to identify the activities to be analyzed and at the beginning of this phase, the analysis of which activities should be brought into the field of analysis. Mostly, the analysis of each activity should include determining the following:

- Is it value-adding or non-value-adding.

- Is it value-adding or non-value-adding whether it is primary or secondary?.

- Discretionary – whether it is absolutely necessary or not.

Value-adding

It has been clarified earlier that, value-adding activities directly contribute some of the ‘value’ to the manufacture of products or rendering of services that are sold to the customer, while non-value-adding activities do not. Primary activities directly support the particular function of the business, while secondary activities simply support the primary activities.

Essential activities are required to be performed at all times, whereas discretionary activities are those that are performed only when permitted by the management.

Cost data gathering

In fact, it is an important step when cost data gathering needs to include the determination of costs incurred by the activities being analyzed. Mostly these costs should include activities, the cost of materials, equipment, and other inputs such as the cost of furniture, associated expenses of development and research.

Tracing of costs to activities

Naturally, if cost tracing is done for activities, it refers to the process of determining where the total cost of each output comes from. If each output of an organization is produced by one or more activities, each of which must have incurred a cost when performed. It is necessary to determine where the costs are coming from in the production processes for the produce, and what activities are required to create the produce.

Establishment of output metric

The establishment of output metrics is concerned with determining the total cost of actually producing the output. It involves calculation of actual activity unit cost for each of the primary activities and generation of bill of activities. The activity unit cost of an activity is the cost of the total inputs divided by the magnitude of the primary activity output. The cost of total inputs should include both the expenses incurred by the primary activity and secondary activities related to it. The volume of activities should be a list of activities required (and their corresponding consumption) to produce the output. The total cost of the activities bill is the sum of each activity unit cost multiplied by its corresponding activity amount.

Analysis of costs

Cost analysis is the stage in which the activity unit costs and activities billed are analyzed to identify areas for further improvement in the business processes of the business.

How to Calculate Activity-Based Costing

Identify specific activities that use resources

Here first we need to identify specific activities to calculate ABC. which use resources, such as design, production, distribution and customer service etc. These activities are called cost drivers. To identify these activities, it is important to thoroughly analyze the company’s processes and procedures and determine which activities consume the most resources.

Determine the total cost of each activity

Once the activities are identified, the next step is to determine the total cost of each activity. This can be done by aggregating the costs of the resources used by each activity, such as direct labor, materials, and overhead.

The formula for determining the total cost of each activity is: Total cost of activity = direct labor + direct materials + overhead.

Identify the cost driver for each activity

The next step is to identify the cost drivers for each activity. A cost driver is a factor that causes an activity to use resources, such as the number of units produced or the number of customer orders.

This can be done by analyzing the data and determining which factors have the greatest impact on resource consumption.

Assign costs to products or services

After determining the total cost of each activity and the cost driver for each activity, the next step is to assign costs to products or services. This can be done by multiplying the total cost of each activity by the cost driver for that activity.

The formula for this is: Total cost assigned to the product or service = Total cost of the activity * Cost driver of the activity.

Determine the unit cost

Once costs have been assigned to products or services, the next step is to determine the unit price. This can be done by dividing the total cost assigned to the product or service by the number of units produced.

The formula for this is: Unit cost = Total cost assigned to the product or service / Number of units produced.

Analyze the data

After determining the unit cost, the final step is to analyze the data. This can be done by comparing the unit costs of different products or services to identify which products or services are the most profitable, which are the least profitable, and which generate the most revenue.

This can be done by creating a report that shows the unit cost of each product or service, and analyzing the data to identify any trends or patterns.

These steps may require data collection and analysis, and implementation of ABC may require significant investment in terms of time and resources.

Furthermore, the accuracy of the results depends on the quality of the data and the accuracy of the cost driver assumptions.

Example of Activity Based Costing (ABC)

It is obvious that if a business makes a product. Then its cost is certain, that is why it is very important to know how much is being spent on the utilities to make the product. Well, there are two methods of costing. One is traditional, and the other is activity-based costing which is called ABC in short.

So friends, let’s see the example for this ABC, how it is calculated?

There is a company which manufactures three types of products:

Product 1, Product 2 and Product 3. Let us assume that the total utility expenditure of this company for one year comes to Rs.2,00,000.

Among them Product 1 – 1700 pieces, Product 2 – 1400 pieces, and Product 3 – 2200 pieces have been produced. And used the utilities for 500, 300, 700 hours, sequentially.

It is important for the public to determine that the cost driver affecting utility expenses is the number of direct labor hours. The number of direct labor hours worked totaled 1,500 hours for the year. To arrive at your cost driver rate, divide your total utility expenses by your cost driver rate (by the number of hours worked).

Count:

So, let’s count:

Three types of products are manufactured: Product 1, Product 2 and Product 3. The company produces.

Total utility expenses = Rs.2,00,000.

Product 1 – 1700 pieces, Product 2 – 1400 pieces, and Product 3 – 2200 pieces are produced.

Product 1 – 500, Product 2 – 300, and Product 3 – 700 hours of utilities used.

Base Count: (1) Overhead Consumption Rate = Total Utility Expenses / Total Hours

(2) Overhead consumption of each product Total cost = Overhead consumption rate x Utilities usage (in hours)

(3) Per product overhead consumption cost = Total cost of production / Per product overhead consumption

(1) Overhead consumption rate = 2,00,000 / 1500 = 133.33

(2) Overhead consumption total cost of each product:

A. < for product 1> 133.33 x 500 = 66666.67

B. < for product 2> 133.33 x 300 = 40000.00

C. < for product 3> 133.33 x 700 = 93333.33

, total = 200000.00 (3) Each Product Overhead Consumption Expense:

A. < for Product 1> 66666.67 / 1700 = 39.216

B. < for Product 2> 40000.00 / 1400 = 28.571

C. < for product 3> 93333.33 / 200 = 42.424

Conclusion

Activity-based costing (ABC) is a method of assigning costs based on the activities required to produce products or services. Thus, compare to traditional cost accounting methods. It is a more detailing and accurate way of determining the costs. Which is associate with the production of these various products or services.

Some of the benefits of ABC include improved cost accuracy. Better decision making, enhanced cost control, increased understanding of customer profitability. Better product profitability analysis, and better process improvement.

ABC can be particularly useful for companies in manufacturing and service industries. That have a wide range of products or services and want to better understand the costs associate with each. However, it is important to note that ABC can be complex and time-consuming to implement. So it may not be suitable for all businesses.